Made In Group

Control Energy Costs

Malthouse Engineering Co. Ltd

MIE Solutions UK Ltd

RK Engineering (Atherstone) Ltd

PP Control & Automation

Strip Tinning

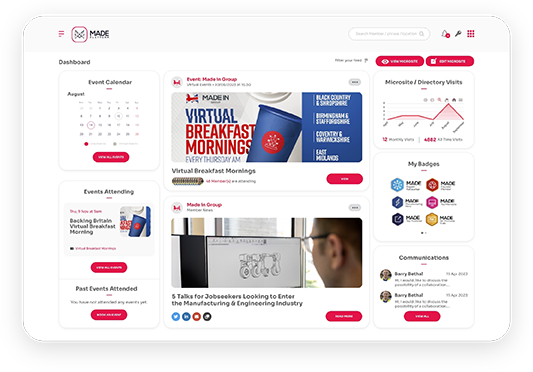

Made in the Midlands, part of the Made in Group, exists to champion and promote UK Manufacturing. This community, along with Made in Yorkshire and Made in London, originated in 2009 as a simple pledge signed by the Managing Director’s of manufacturing firms to do 3 things:

Brand exposure from MIM through PR and other platforms is great for getting the message out there. The way they connect manufacturers and champion British manufacturing is beneficial industry.

Charles Boneham, Boneham & Turner

MIM provides a great platform that enables us to support local businesses and put money back into our economy. It is nice to know that you are part of a group who all have the same interests at heart.

Tony Sartorius, Alucast

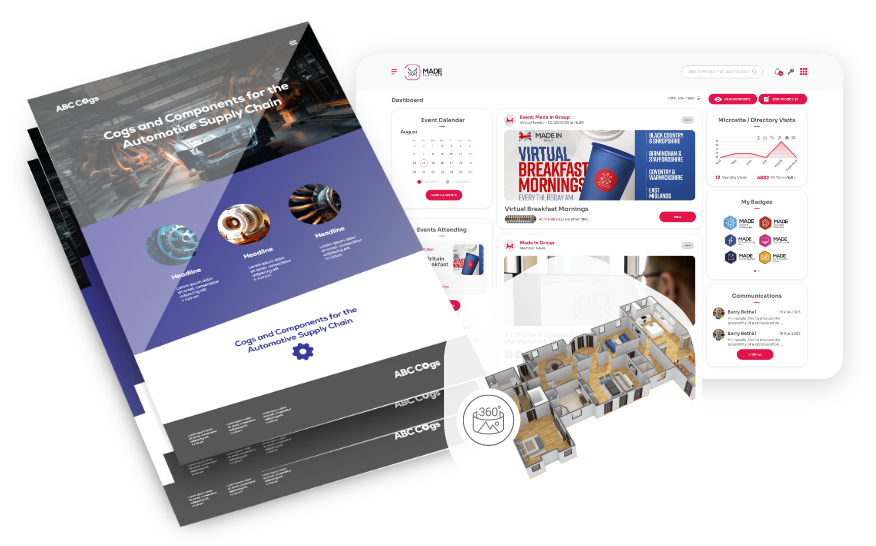

I can recommend engaging with the Made in Group to kickstart your web-based profile and lead generation. The team are marketing savvy and know how to create a simple but effective website.

Nigel Maris, Assemtron Ltd

“MIM is our emotional bank account. You can never put too many deposits into our Membership. The more interaction we have the more withdrawals “Leads” we make.

Tim Gears Hexagon Metrology Ltd©Copyright. 2024. All rights reserved.

Privacy Policy | Terms & Conditions

Made in the Midlands is a licensed franchise of Made in Group.

Enter your name, email and company to connect to a member of our team